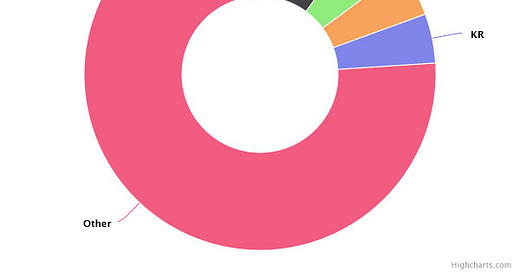

After the last rebalance the top-5 positions in the index have changed, it also has added several new positions. Below we show the new top 5 positions which come from different sectors. Estée Lauder (EL) operating in prestige beauty, Abbvie (ABBV) in healthcare, AptarGroup (ATR) in packaging, Skyworks (SWKS) manufacturing RF chips, and Kroger (KR) in the grocery space.

Three of the five are relatively cheap with low forward P/E’s, AptarGroup and Estée Lauder look a bit pricey. In Estée Lauder’s case it has been growing at a pretty decent pace, so it could be justified. The convolutional neural network that picks these companies does take a lot of factors in consideration, including growth, margins, etc. As well as valuation ratios, so there has to be something the algorithm liked for it to have picked them as companies likely to outperform the market.

All five of these companies pay a dividend, with Abbvie being by far the most attractive.

In terms of growth, we particularly like Skywork’s profile, its growth has been accelerating an in the most recent quarter hit 37%. Not surprisingly Kroger has a low growth rate, which is to be expected from a mature grocer.

In the next post we will share the positions of the entire index. That post is for subscribers only, if you would like to support us and the cost of maintaining the Widealpha AI-Selected index please consider subscribing to our substack. Have a great day!

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. We cannot guarantee profits or freedom from loss. You assume the entire cost and risk of any trading you choose to undertake. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.